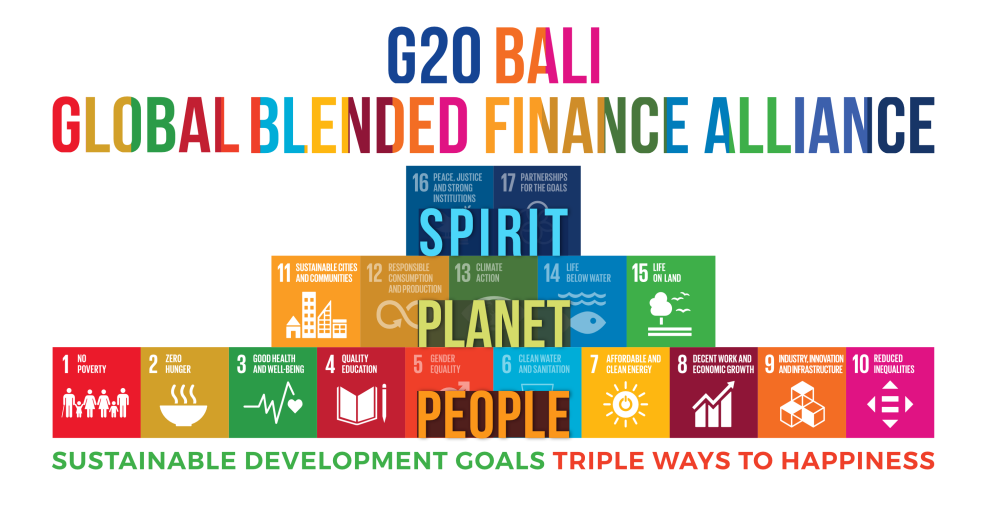

Our vision is to build a global community of support to fill the SDG Financing and Knowledge Gap, facilitate policy development to scale up blended finance solutions in developing countries, and to promote South-South collaboration.

“Indonesia is committed to promoting blended finance initiatives to attract private investment for sustainable development projects, particularly through the G20 Bali Global Blended Finance Alliance. This alliance aims to scale blended finance for developing countries, modernize the development finance system, and foster South-South cooperation to support climate action and the Sustainable Development Goals (SDGs)”

President Prabowo Subianto

in CNBC report

FEATURED VIDEOS

G20 Bali Global Blended Finance Alliance for climate finance and the SDGs for developing countries.

G20 Bali Global Blended Finance Alliance ‘Letter of Intent’ Signing by nine countries.

Unveiling of G20 Bali Global Blended Finance Alliance Secretariat in Sanur SEZ, Bali.

In the US, for every

$1

in public funds,

$20

in private investments

can be mobilized.

Mobilisation from concession funds is low for developing countries.

In 2022, for every $1 of climate finance MDBs provided, they mobilized $0.28 in private finance.

Global South faces a funding gap of $2-3 trn a year for climate action

Climate Finance Barriers in Developing Countries

Unlocking

investment for

Global South

The 3 Key Pillars of the G20 Bali GBFA

to strengthen developing countries’ capacity to mobilize finance at scale through South-South cooperation.

Design a country-led platform around clear focus areas (e.g. energy transition; nature-based solutions for forestry and oceans, sustainable food production, and sustainability of water)

Find opportunities for South-South Collaboration

Facilitate creation of pipeline of bankable project

Project/deal matchmaking

Standardized tools, guidelines, templates e.g. tools and templates for pipeline, database

Knowledge products e.g. documentation and sharing of case studies, flagship annual report

Training, exchange, secondment programs

Facilitate policy development on blended finance under South South cooperation project

Project/deal matchmaking

Peer to peer learning network

MDBs/FI and donor engagement, e.g. joint advocacy

Private sector Engagements, e.g. investor events

Creation of convening platforms for all parties to come together working with many partners

Why Support

G20 BALI GBFA?

A Chance for Legacy.

By partnering with G20 BALI GBFA, stakeholders will contribute to global change by accelerating and scaling up financing for SDGs & climate action.

Participation in the organization will give founding members the possibility to help set the direction of the institution and support in implementation.

Through their contribution all partners to this important initiative will:

Achieve a lasting impact on SDGs & climate action related objectives.

Establish their position at the forefront of innovative finance.

Ensure sustainable, tangible results for investments.

Blended Finance

One of the best levers to mobilize private capital for climate action and the SDGs

Blended finance is the strategic use of catalytic capital (e.g. from donor governments, development banks or philanthropies) to mobilize additional private finance for SDG-related investments – often through the use of de-risking mechanisms like guarantees, insurance, currency hedging, first loss capital or technical assistance.

Blended finance can serve as an efficient and strategic mechanisms for closing SDGs & climate action financing.

Amplifies the impact of public and philanthropic funds by attracting private sector investments.

Development finance can absorb higher risks, making projects more attractive to private investors.

Enables the fusion of public purpose and private sector efficiency for sustainable results.

By subsidizing costs, projects that might not have been financially viable become achievable.

Offers longer-term investment horizons, allowing projects the time needed to mature and deliver impact.

Drives systemic change by demonstrating proof of concept, thereby encouraging more investments in similar projects.